On the other hand, online lenders have more relaxed qualifications. But again, expect them to charge higher rates than traditional banks. Business lines of credit are suitable for short-term financing needs and handling business cash flow. SBA loans offer some of the lowest business loan rates in the market and long payment terms. It also allows you to borrow up to $5 million in business loans. This option is a good fit for borrowers with strong credit records.

Nội Dung Chính

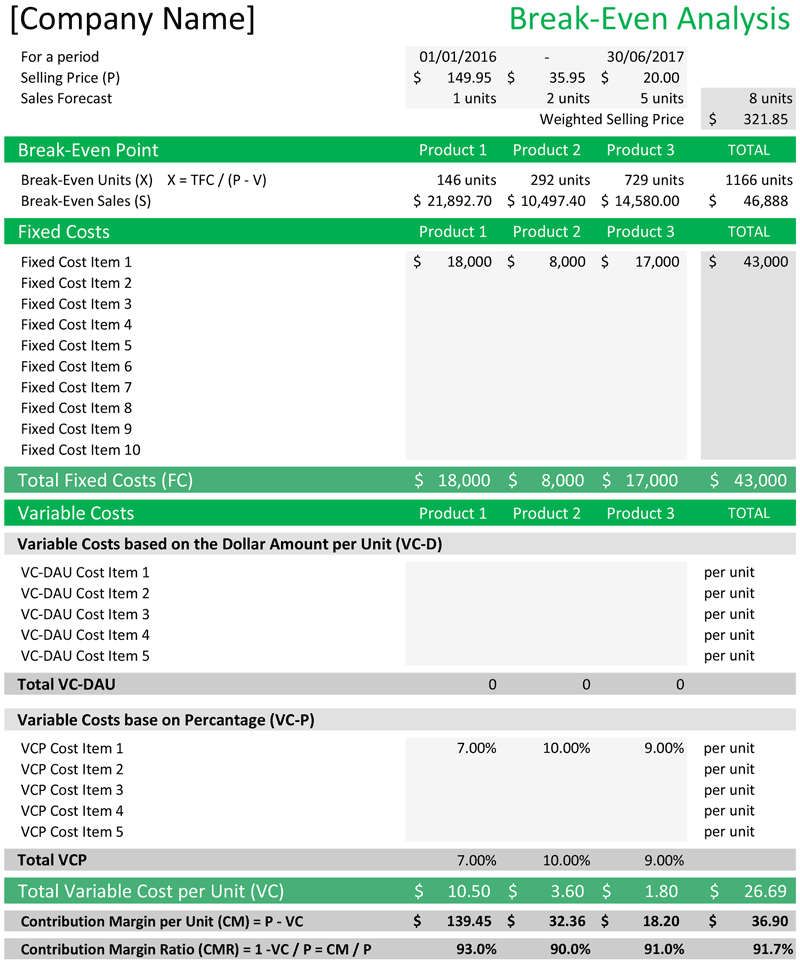

How To Calculate Break-Even Point?

Explain the challenges of maintaining your business, and if they could help adjust your rent. Landlords may actually agree to reduce your rent to keep you for the long-term. This is a better proposition, especially if they know they’ll have a hard time looking for a new tenant. If your landlord won’t adjust your rent, consider looking for a more affordable space for your business. In investing, the break even for a stock or future trade is estimated by comparing the market price of an asset to its original cost. Investors reach the breaking point when the original cost and the market price of the asset are the same.

Do you already work with a financial advisor?

However, the cost of producing your product is likely to increase over time. When this happens, expect your BEP to increase because of the higher expenses. Besides the production costs, other variables such as utilities, rent, and employee salaries will also increase over the years.

When determining a break-even point based on sales dollars:

Unlike a term loan that provides lump-sum funding, a business line of credit allows you to keep withdrawing and repaying your loan as often as you want, up to an approved limit. Lenders will allow you to repay your entire balance early, which lets you save on interest charges. Lines of credit also usually come with adjustable interest rates, unlike fixed-rates on term loans or SBA loans. Term loans are some of the most common types of business financing.

This helps you craft a more formidable strategy and reap better benefits for your company. On the other hand, large companies find it easier to manage their inventory by using complex tracking tools. Besides using more sophisticated software, they can meet on-time customer demand while keeping just enough products in their inventory.

Calculating the break-even point in sales dollars will tell you how much revenue you need to generate before your business breaks even. Here are four ways businesses can benefit from break-even analysis. Want software that can help you calculate your break-even point? Check out our piece on the best bookkeeping software for small-business owners.

No, the break-even point cannot be used to predict future profits. It is only useful for determining whether a company is making a profit or not at a given point in time. In order to calculate your break even point (the point where your sales cover all of your expenses), you will need to know three key numbers.

- These are essential operational expenses that keep your business afloat even when you’re not producing goods.

- It makes the difference from operating at a loss to achieving financial goals and expanding production.

- Often times you will find the need to adjust your costs and factor in things you overlooked before.

- Tracking this data over time can help you identify patterns — e.g., slower sales during specific months — so you can adjust your strategy based on those trends.

- It’s important to study the feasibility of any project or new product line that you’re planning to launch.

But of course, the sooner you can recoup costs, the sooner you can earn and increase your profits. However, it might be too complicated to do the calculation, so you can spare yourself some time and effort by using this Break-even Calculator. All you need to do is provide information about your fixed costs, and your cost and revenue per unit. To make the analysis even more precise, you can input how many units you expect to sell per month. One limitation of break-even analysis is that it assumes selling prices will stay the same over time. In reality, prices often fluctuate due to market conditions, competition, or changes in demand.

It works for business owners who want to expand their company or refinance existing debts. On the other hand, it’s not ideal for entrepreneurs who need funding right away. Increasing Production Costs – In other cases, demand for your product may remain the same or stay steady.

They can also change the variable costs for each unit by adding more automation to the production process. Lower variable costs equate to greater profits per unit and reduce the total number that must be produced. As you can see there are many different ways to use this concept. Production managers and executives have to be keenly aware components of the master budget of their level of sales and how close they are to covering fixed and variable costs at all times. That’s why they constantly try to change elements in the formulas reduce the number of units need to produce and increase profitability. If you don’t reach the BPE within the desired timeframe, you’re in danger of incurring losses.

Wouldn’t it be great if there was a tool that would allow you to quickly and easily estimate and graph a company’s break-even point? Look no further; at PM Calculators, we present you with our online version of a break-even calculator to obtain it quickly and online. Let us go through a break-even analysis step by step to illustrate its usefulness with a real-life example of starting a business. Also, remember that this analysis doesn’t take into consideration the present vs. future value of your funds.